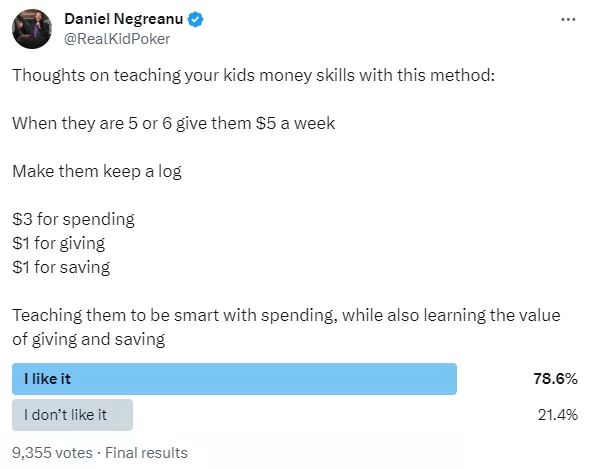

Thoughts on teaching your kids money skills with this method:

When they are 5 or 6 give them $5 a week

Make them keep a log

$3 for spending

$1 for giving

$1 for saving

Teaching them to be smart with spending, while also learning the value of giving and saving

How much will they save to play poker?

To do this, I will teach them how to borrow. Let them repeat after me: “Don’t worry, it’s a great table, I’ll probably win back and return everything to you as quickly as possible!”

You definitely didn't have children if you're suggesting this, lol! It’s worth starting at the age of nine or even ten.

The author of this idea has many children and grandchildren, and he always started at the age of five or six.

Jesse Martin (famous WSOP live regular):

I think this is a good idea. It's just that the numbers are kind of strange. What can they do with those three dollars? Which basket will your gifts be paid for?

Everything I give is from myself; this money is not included in their budget. What can they buy with three dollars? Ice cream. Chewing gum in the machine. Small toys. You never know! The idea is for them to understand that if the thing they want costs $5, they have to wait a week.

Swap charity for investment.

No. They can invest what they save. And charity is absolutely the most valuable thing I want to teach them.

Give the child $5. Subtract $2 to teach taxes. Subtract $1 for housing and $2 for food. This will be a good lesson.

Mike McDonald

The best way to teach taxes is to first give $5, and then take $6 and spend it on something they hate.

Haralabos Voulgaris

Teaching them to save money isn't a bad idea, but to make it fully work, take away 5% of their total savings once a year to show them the difference between keeping money under their pillow and investing.

Ari Engel

(MTT veteran, one of the first online grinders, still plays successfully)

I have exactly the opposite suggestion: add 7% per year to their savings so that they feel the value of the investment. And you shouldn’t explain to them about dispersion – it doesn’t teach anything good, no matter whether it’s a positive or negative turn.

I like. My parents tried a similar system when I was six years old (my father is a licensed accountant, my mother is the head of finance at a bank). Some amendments:

1) Money is not given out just like that. They need to be earned by helping around the house, at garage sales, and through any other creative means (selling lemonade, etc.).

2) From time to time, my father has the right to borrow from my savings, but he is obliged to repay the debt with interest – usually about 10%. Takes $5, returns $5.50. I remembered the lesson about debts and interest very, very well and later taught it to my younger brother.

I have used other modifications of this technique with my children. The first daughter spent everything on herself and her friends: 70% on expenses, 30% on gifts, no savings. Second: 60% for yourself, 30% for gifts, 10% for savings (bitcoin).

It is easier to teach young children about charity than about saving. This probably changes with age.

Ron O'Connell

Teach them to save half of all income, always. I've been doing this my whole life, and by the time the banks stole all the money and crashed the market in 2009, I had saved over a million in 32 years. No loans: if I don't have the full amount, I don't buy anything.

Today, the only way to save money is to buy gold and other precious metals that the bank can't steal.

So split their pocket money in half and give half of it in gold coins or trading cards. I've been collecting trading cards my whole life and my son will have a collection of 60 years of baseball, football, hockey, and basketball cards, as well as lots of coins.

I don't think five dollars a week is enough for a good lesson, and I wouldn't recommend spending more than 5% of your savings on charity, making exceptions only for special occasions.

@DrAlexChauran

We followed a similar path. At five years old, kids don't understand much, but we bought a special box with slots leading to savings, gifts, and spending compartments.

@AdvancedLivin

I agree that children should be taught financial literacy, but starting at five or six years old is too early. Let your children enjoy that short time in life when they don't have to worry about money or have to do accounting.

I would start after finishing primary school.

@HowdoIpoker

My parents started when I was five or six. They gave out $2 a week. I could spend $1.5 on myself, save 0.25 and give 0.25 to the church. I think it helped me understand the value of money and I learned to save to get what I needed.

@ThePokerKaren

If you just give five dollars a week, the child will not learn anything. First, teach him how to earn money. Then you can go further and instill the basics of money management. Personally, I started earning money at about the same age, helping my father in construction, and he gave me $5 a day.

@dftba.club

The idea is normal, but let the figure of five dollars remain on the conscience of the grandfather who told you about it. This amount was probably relevant for his first-born.

@AdamBlackhall

Our version: we gave out an amount equal to the age (at five years old – $5, at nine years old – $9, etc.). The child must put a dollar in each basket, and spend the rest as he wants.

@CookieInTO

We started giving money to our daughter when she turned six. They gave it away for a reason, but for doing housework. If he doesn’t clean his bed, he won’t receive his weekly payment. Half of the money should be saved or invested. The idea of investing struck her to the core.

We did not allocate charity and gifts separately but included them in the budget for personal expenses.

@ClayTumey

Yes, I would also prefer that children not receive money, but earn it. Although I won’t say that this is critical for me.

Our proportions were also slightly different: 10% for gifts, 20% to save, 70% to spend.

We started when the child was 8 or 9.

10/10, highly recommend.

@rhpMike

Like. Financial literacy should be taught as early as possible. I would give money for housework beyond the mandatory; that is, the child must have responsibilities that must be fulfilled anyway, but anything we ask them to do beyond that must be paid for.

@EVplusEV

My son is now 12. He started saving a long time ago and has never touched his piggy bank – he is delighted with the accruing interest. I hope this lesson stays with him throughout his life.

@ramsay_romero

My parents did this to me. Their system just infuriated me. Damn, what have I learned! And now I’m not very friendly with money.

David Williams

(2nd place in the main event of the 2004 World Series)

Disgusting idea. Just give him $5 and let him spend it on lottery tickets. It’s better to prepare for a career as a gambling addict in advance!

What do the professionals advise?

2-3 years

Young children may not understand the value of money, but they will enjoy learning the names of small coins. You can play the game “find out the coin”. Just make sure they don't put the coins in their mouths! When they are a little older, you can play in the store – they usually really like it.

4-5 years

Before you go to the store, ask your child to help you cut out coupons (remember to use safety scissors). At the store, give him coupons and let him help you find the items you need. Children are inspired when they can help adults with something.

You can play restaurant at home. Children love to set the table, practice good manners, and choose their own food. 4-year-olds at first forget that they need to pay the bill before leaving, but when you remind them, they do it with great pleasure, both with play money and with real money.

6-8 years

At this age, children begin to understand what money is. As soon as you start giving out pocket money, you definitely need to teach your child to save something. Go to the bank with him, open a savings account, and teach him to make regular deposits. Many banks offer the opportunity to open a children's account without commission and minimum balance. As the balance grows, tell your child why the bank charges interest on the deposit.

In elementary school, many children begin collecting coins. This hobby can also spark an interest in finance.

9-12 years

You can already go shopping. Go to several stores and show that prices for the same products may vary. Draw your child’s attention to the size of the package and teach him to compare the price per kilogram. Explain that some products may be of better quality than others, and this is also reflected in the price.

When you do a traditional garage sale, put the child in charge. With minimal supervision, he will easily cope with the task, learn to determine a decent price, and will be happy to bargain with customers.

13-15 years

Only from this age does it make sense to teach budgeting. Expenses begin to increase and become more complex, which means it’s time to learn to determine the essentials and choose between excesses. It's also time to talk about the stock market, charity, and social responsibility.